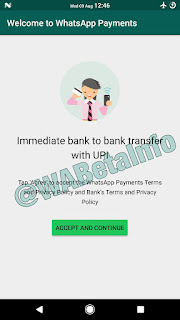

As PayTM announced its foray into messaging business, WhatsApp is doing the opposite. WhatsApp is getting closer to enabling payments over United Payments Interface as the feature was spotted in the beta version of the app. The beta leak from WAbetaInfo stated that WhatsApp Payments will offer bank-to-bank immediate transfer with the UPI.

It seems like payments are the new frontier for messaging apps. The user needs to agree to the terms and conditions put forth by WhatsApp, National Payments Corporation of India and banks.

WhatsApp Payments will be a boost for Digital India and Make In India mission as it uses indigenous technology which is developed here in India. The UPI saw a 12% growth in the total transaction volumes taking place between June and July 2017. The Number of transactions grew by 1.28 million in July 2017 whereas the total amount transacted increased by, up by Rs 313 crores. In June 2017, volume had increased by 1.19 million and amount transacted had grown Rs 333.05 crores.

Dr Ajay Kumar, additional secretary for Ministry of Electronics and IT confirmed this news via Twitter. Proposed WhatsApp Payment system in India to be powered by NPCI BHIM app, he tweeted. Information regarding UPI payment address is yet unclear. Users on BHIM are allowed to select the primary and secondary address on its own @upi handle. For example, you can send me money on my UPI handle at theindiancapitalist@upi. Samsung Pay with its partnership with Axis Bank uses @pingpay handle. Experts are of an opinion that WhatsApp Payment users may get the choice of using both @upi and @whatsapp UPI handles.

WhatsApp has more than 200 million user base in India. It is also amongst the most misused application in India. Indians are continuously affected by scams, fake news and data stealing scandals on WhatsApp. For security purposes, WhatsApp needs to verify user KYC details. Some security protocols will need to be implemented around payments through WhatsApp. If it decides to use Aadhaar, then we will have to enable biometric authentication. It can also use BHIM enabled BharatQR for additional security features.

Payments through messaging app are widely used in China. Alipay and WePay have combined 1.1 billion users. Online payments through non-bank payment services in China expanded 60 per cent in the first quarter to 47 billion transactions valued at 26.47 trillion yuan (US$3.9 trillion), 43 per cent more than last year. India's payment revolution is sparked by Modi's daring demonetisation announcement. PayTM and BHIM was an instant hit among locals. PayTM's messaging app and BHIM partnership with WhatsApp will bring golden days in digital payment space in India.

- Chaitanya Kulkarni.

No comments:

Post a Comment