Bitcoin

uses peer-to-peer technology to operate with no central authority or banks;

managing transactions and the issuing of bitcoins is carried out collectively

by the network.

Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

Bitcoin

is second only to gold on the list of topics guaranteed to arouse the wrath of

the Internet trolls. Yet relentless promotion can’t hide these facts: The

digital currency peaked at a value of $1,130 just over a year ago. Its plunge

of more than 56% in 2014 makes it the world’s worst performing currency this

year, according to Bloomberg, which tracks 175 foreign-exchange values: Bitcoin

claims to provide Web buccaneers with a secure store of value free from the

risk of government confiscation or interventionist devaluation, making it the

currency of choice for old-fashioned money-launderers and modern-day snake-oil

salesmen.

RBI Governer Raghuram Rajan’s take on Bitcoin

Raghuram Rajan,

governor of the Reserve Bank of India (RBI), said digital currencies such as

bitcoin would be helpful in the transition towards a cashless society, as they

become better and safer in the future. Rajan said the digital currency is

"fascinating", despite apparent drawbacks.

"I think we are still watching the evolution of these

kinds of currencies," he said.

"One of the problems that we envisage with bitcoin is

security issues. You've seen that it is not as secure as people thought they

were and there have been stolen bitcoins and so on."

"But the second issue is the fluctuation in value. For

money you require a stable store of value. Something that fluctuates so much is

less effective for use as money."

However, Rajan noted that the technology used in digital

currencies is promising, and they will become safer and better in future.

"Some of them are useful, some of them are worrisome and

we have to see how we take on such technologies," he said.

"I have no doubt that down the line we will be moving

towards primarily a cashless society and we will have some kinds of currencies

like this which will be at work."

"Over time they will be a form of transaction, that's

for sure."

He

added that central banks across the globe could one day embrace a digital

currency system.

The RBI, like many of its peers across the globe, has earlier

issued warnings about the use of digital currencies. It advised customers to

exercise enough caution before using them as an investment and a mode of

payment.

BTCXIndia is India’s real time bitcoin exchange

India now has a

full and compliant bitcoin exchange called BTCXIndia – also featuring a live

trading platform and wallet service – which launched officially on

5th May 2014 in the southern city of Hyderabad.

It's a significant

step for the country's bitcoin economy as its previous exchanges, some of which

operated as fixed-price buy-sell platforms, lived with a degree of regulatory

uncertainty since a series of government warnings and raids on bitcoin

businesses in December and January.

BTCXIndia currently

has 10 staff members, working in development, customer services and

compliance. Investment comes via a UK company that has funded the exchange for

at least one year, and is also working as a strategic advisor to the management

team.

BTCXIndia keeps

the absolute majority of the coins it holds in cold offline storage, and is

also working on a proof-of-reserves implementation and "other interesting

features" to reassure customers their funds are always 100% safe.

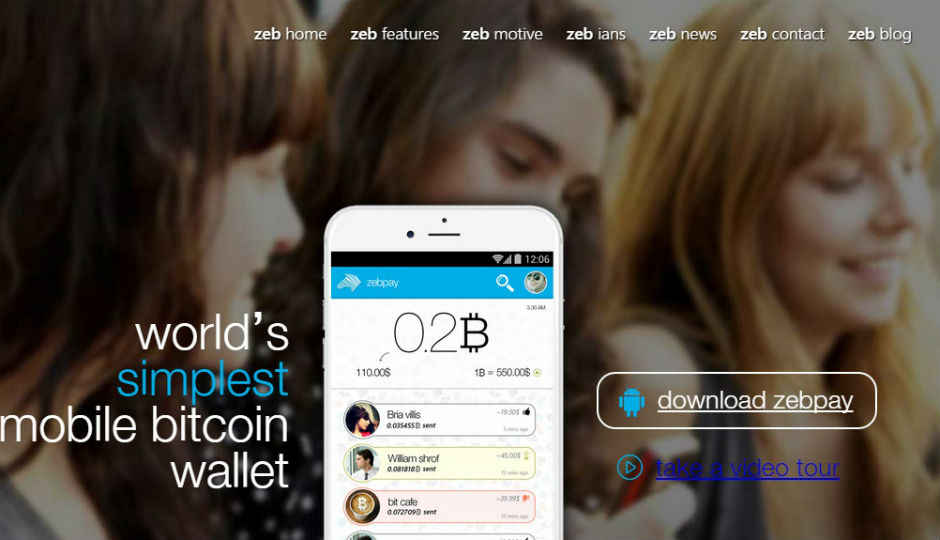

Meet Zebpay, India's first mobile Bitcoin wallet

It is the first

mobile Bitcoin wallet in India and perhaps the simplest in the world. Its goal

is to get more people to use Bitcoins and in order to do so, avoid all the

confusion that comes with it. Registering and creating your wallet is as simple

as verifying your mobile number through an automated message sent to the mobile.

Currently, Zebpay

is going to allow users to buy Flipkart coupons and similar other things from

the app. Unlike PayTM though, Zebpay is not bound by the rupee. The Zebpay app

is a global app, which means you can use it for transactions worldwide,

wherever Bitcoins are allowed. That obviously makes for a select few places,

but it’s a start nevertheless.

The app itself is

very simple to use. The Android app can be downloaded from the Play Store,

while Zebpay has already submitted the iOS app to Apple as well. Once

downloaded, the user undergoes a WhatsApp like verification process, where a

text message is sent to his/her mobile with the verification code. This

completes the verifications process. Currently, adding Bitcoins will require

you to create a wallet on iGot.com, but Zebpay plans to allow this through the

app itself. The company will ask for a KYC from the customer, following which

one can buy Bitcoins directly through the app.

One thing that the

three founders often reiterated at the launch was the Zebpay is a ‘spend

wallet’. This means it is intended to be an electronic version to your physical

wallet. Just like we keep the bulk of our money in the bank and carry around

physical banknotes for our regular expenses, Zebpay wants you to keep the bulk

of your Bitcoins in cold storage, while only the amount you need for regular activities

should be carried around in the wallet.

Regulatory confusion

Bangalore-based exchange Unocoin launched in

December 2013 during that city's first bitcoin conference, saying it intended

to be fully compliant with customer verification procedures and other

regulations.

On 24th December, however, the Reserve Bank of India (RBI) issued a

warning that Unocoin and others like it were operating without

approval, causing the exchanges to cease all services as a precaution.

Ahmedabad's Buysellbitco.in was raided and

information service CoinMonk received

a visit from tax officials seeking more

information. Unocoin, owned by the same group as CoinMonk, came back online in

the first week of January, however, and is still in business.

Top 5 countries for Bitcoin Download

Next big thing

In December, the bitcoin community turned to India as its

next great hope after Chinese government statements caused the price to drop from its record high of

$1,200. India is an emerging economy with a population of over a billion

people, nearly half of whom are unbanked or under-served by banks.

It also receives around $70bn in overseas remittances per year, making up 4% of its GDP. Together with its roughly 250m Internet users and a proclivity for high-tech industry, India would seem perfect for the introduction of a breakthrough financial technology like bitcoin.

Reads related to the article

http://www.huffingtonpost.in/2015/02/02/indian-bitcoin-trest_n_6592792.html

http://in.reuters.com/article/2015/03/12/bitcoin-ibm-idINKBN0M82K920150312

http://www.businessinsider.in/The-future-of-Bitcoin-is-China/articleshow/46535180.cms

Thank you for reading.

Follow me at twitter.com/chai2kul

Black Friday Hitsis great, firstly to increase sales of businesses, secondly to save money on shopping for consumers, while increasing shopping needs, contributing to the development of the country's economy.

ReplyDelete